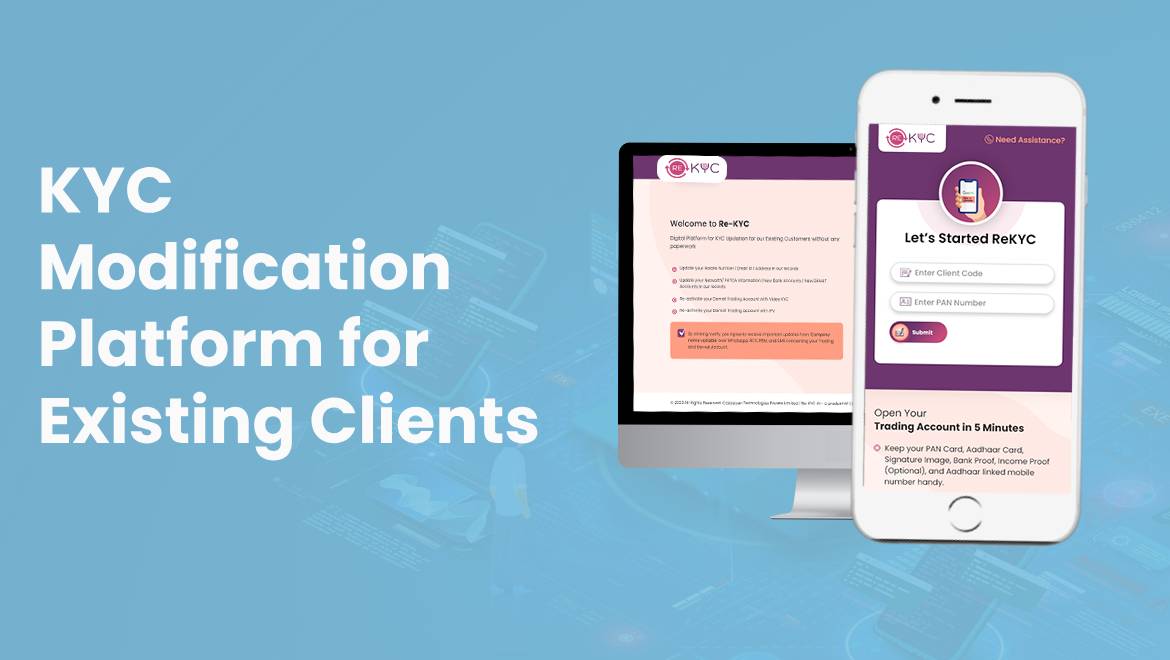

ReKYC AI

ReKYC AI is an Artificial Intelligence (AI) based digital KYC modification solution which enables market intermediaries to completely transform their entire KYC process into paperless mechanism.

As an industry average, 70-80% of all clients of any Stockbroker are dormant clients. ReKYC AI helps Stock Brokers to Re-activate these clients so that they can take advantage of the business potential from existing inactive customer base.

Intermediaries can also collect client's FATCA, Income & Net-worth related information which is their annual obligation as a reporting agency under PMLA guidelines.

Re-KYC connects multiple APIs of Back-Office to seamlessly transform the business operations. Solution has been designed as per the guidelines published as per the market regulators time to time so that the compliances are managed by the system without manual interventions. ReKYC AI saves huge money and reduces service latencies. It enhances overall customer experience and happiness quotient.

Unique One Stop Digital KYC Platform to quickly do the modification for the broking Customers.

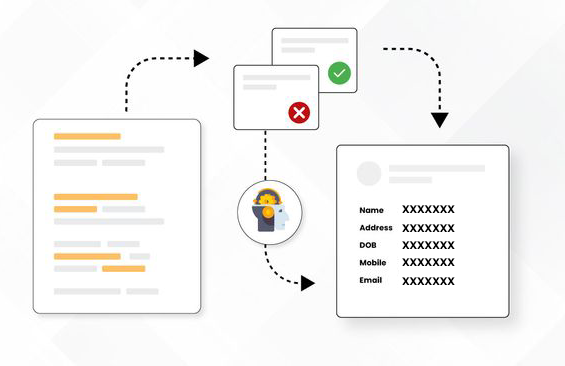

Process made simple for client by:

- Fetching data & documents from Regulatorily approved sources like Digi Locker, KRA etc.

- Authenticating data through external APIs

- All the data and documents are verified through Artificial Intelligence (AI) for faster onboarding without any manual intervention.

The features included in the software for modification/addition:

- Mobile No.

- Email ID

- Correspondence Address using DigiLocker / Manual mode.

- Permanent Address

- Basic KYC Information

- Bank Addition with Penny-drop authentication

- Demat account Addition

- FATCA & Income/Net-worth

- Re-activation

- Nominee addition

- Segment Addition

- Closure (Demat & Account)