Are you looking for the

Best KYC Management

Software

Powered With

Artificial Intelligence (AI)

A simple solution to enhance the optimal productivity of your business.

We provide a

One-Stop-Shop comprehensive eKYC Platform

(Electronic Know Your Customer) solution that aims to meet the 24x7 business needs of your clients.

The idea behind a one-stop-shop solution is to enhance efficiency, reduce complexity, and improve the user experience by consolidating multiple functions into a single, user-friendly platform.

12+

Years

Of Experience

5M+

Applications

Processed

99.8%

Uptime

What we Offer

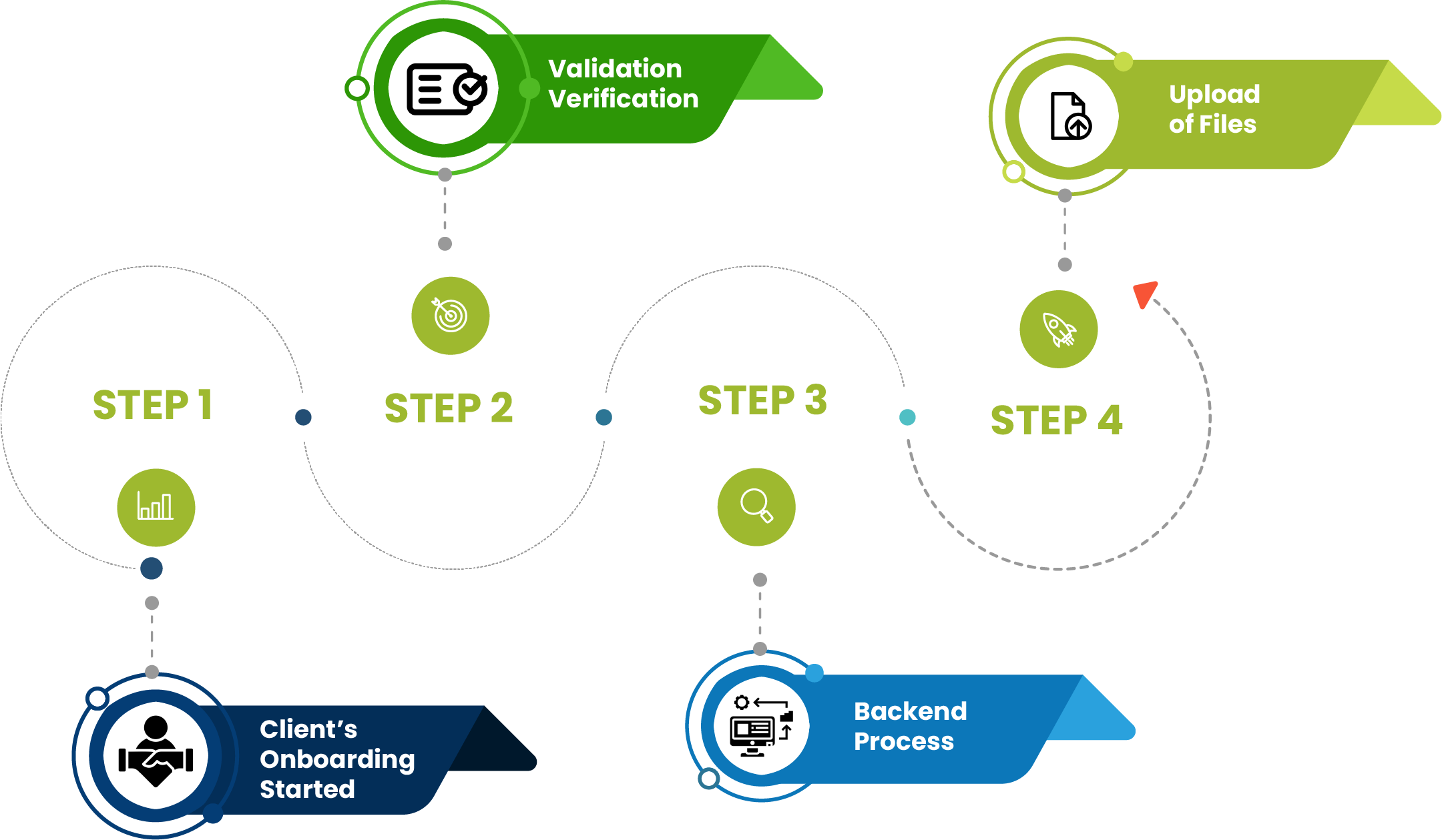

We provide ecosystem for end-to-end digitization of the KYC (Know Your Customer) process, which involves automating and streamlining every step of the customer onboarding and verification journey. This not only enhances operational efficiency but also improves accuracy and compliance.

Developed a user-friendly online portal or mobile app for customers to initiate the onboarding process.

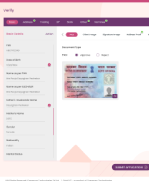

Document VerificationWe use machine learning algorithms to verify document authenticity and detect any signs of forgery or tampering.

Biometric AuthenticationIntegrated biometric authentication methods, such as fingerprint, facial recognition for enhanced identity verification.

Data Validation and EnrichmentValidate customer information against external databases to ensure accuracy.

Risk AssessmentUtilize data analytics and machine learning models to assess the risk associated with each customer.

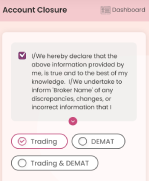

Electronic SignaturesImplemented secure electronic signature solutions to facilitate the completion of legal documents and agreements.

Integrated real-time compliance checks against global watchlists, sanction lists, and regulatory databases.

Customer CommunicationAutomated communication with customers throughout the onboarding process, keeping them informed of the status and any additional requirements.

Data Encryption and SecurityRegularly update security measures to stay ahead of emerging threats.

Scalability and IntegrationDesigned the system to scale with the growth of the customer base.

Regulatory ComplianceConduct periodic audits to ensure ongoing compliance with KYC regulations.

Continuous ImprovementEmbrace emerging technologies and industry best practices to stay ahead of the curve.

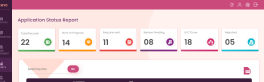

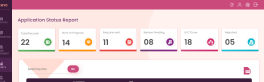

Get a live look of your

business process

QuicKYC AI

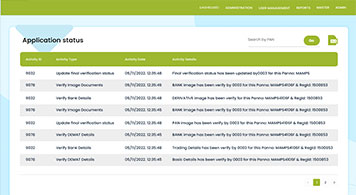

Enterprise KYC Management Softwaree-KYC, or Electronic Know Your Customer, is an Artificial Intelligence (AI) technology-driven process that enables businesses and organizations to verify the identity of their customers electronically.

- AI based system driven validation & verification.

- Aadhaar/KRA based KYC fetch.

- Works in 24x7 business model

- Complete back-end automation

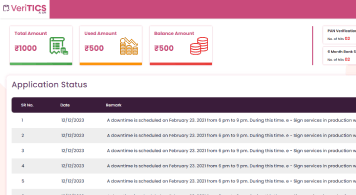

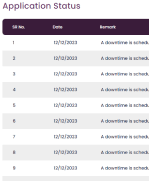

Veritics

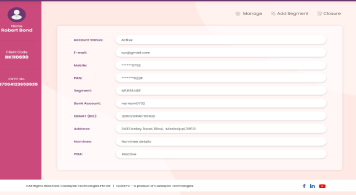

Empower your organisation with cutting edge AI. Your complete API solutions for business needs.Veritics offers a comprehensive bundled solution with integrated APIs for seamless KYC, identification, and verification. This encompassing package includes APIs for streamlined OCR data extraction, government document verification, Name Match, Face Match, Liveness detection, and Latitude-Longitude recording.

- Built-in AADHAAR Integration

- Document Automation with OCR

- Bank Account Verification (penny drop)

- Face Detection & Compare

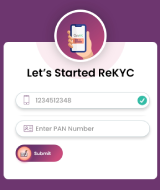

ReKYC AI

Modification of KYCReKYC AI is an Artificial Intelligence driven digital KYC modification solution which enables market intermediaries to completely transform their entire KYC process into paperless mechanism.

- AI based system driven validation & verification.

- Works in 24x7 business model

- Complete back-end automation

Backend Automation

The upload of regulatory files is a critical process which often involves sensitive and compliance-related documents. We streamline and automate the entire processes on the server side of applications and systems. Ensuring a secure, efficient, and compliant upload process. This can lead to increased efficiency, reduced manual intervention, and improved overall system performance.

- User Authentication and Authorization

- Secure File Transfer

- Automatic File Scanning for Errors